Interline Wrap of the week

- Fleet Captain James

- Jan 25

- 2 min read

We are starting to see some exceptional deals drop, the best of which I have highlighted below.

February is Wave Season, the most significant sale period of the year. During this period, retailers tend to focus on retail discounts.

Later in February, their yield management teams started to get very nervous about distressed inventory—voyages that are unlikely to sell out.

They know, and I know, that once they hit March, it will be almost impossible to find punters willing to travel in April and May, and this is when they start to panic and throw the baby out with the bathwater, and this is what will drive the best discounts that will be offered in 2025.

That being said, there are many great deals below that I would jump on now before they sell out.

Antarctica—APT has again chartered Seabourn, meaning fewer cabins will be available. If you are keen to go next season, from October to March 2026, you should look carefully at the Silversea deal we have in October this year. I am not sure how many more we will get across all brands.

I am meeting with Panant this week to try to negotiate some interline pricing for Antarctica and the Kimberley.

Azamara

Crystal

These price points are for ocean view - balconies are a few hundred more each.

Explora

Interline rates - many include On Board Credits for shore excursions

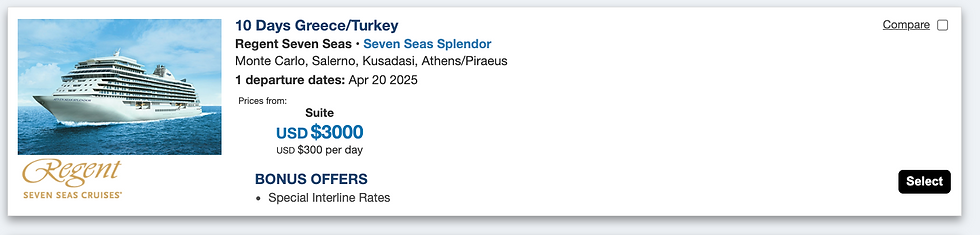

Regent - include everything, even shore excursions.

Alaska

Seabourn

There is almost no movement about Seabourn; they are being cagey and will have to move soon.

Silversea

Dozens work out at under $2500 USD pp per week, which is an incredible value as shore excursions are included as well as full open bar, mini bar and you get your own butler.

Azamara

Comments